- Get link

- Other Apps

The concept of money laundering is very important to be understood for those working in the monetary sector. It's a process by which dirty money is transformed into clean cash. The sources of the cash in actual are legal and the money is invested in a method that makes it look like clear money and hide the identity of the legal part of the cash earned.

While executing the financial transactions and establishing relationship with the brand new customers or sustaining present clients the obligation of adopting adequate measures lie on each one who is a part of the organization. The identification of such element at first is easy to cope with as an alternative realizing and encountering such conditions afterward within the transaction stage. The central bank in any country supplies complete guides to AML and CFT to combat such actions. These polices when adopted and exercised by banks religiously present enough safety to the banks to deter such situations.

National Risk Assessment of Money Laundering of the Bailiwick of Jersey Foreword Financial crime is constantly evolving and becoming more sophisticated and complex meaning that new threats are regularly emerging for Jersey. In September 2020 Jersey published its first National Risk Assessment of Money Laundering report and I am pleased to now publish Jerseys first National Risk Assessment of Terrorist Financing report.

The Factors Of Money Laundering Download Scientific Diagram

As part of Jerseys ongoing work to prevent financial crime the Island has undertaken a risk assessment for money laundering and terrorist financing.

Jersey money laundering risk. The National Risk Assessment for Jersey in connection with money laundering risk was published in September 2020 the Assessment. The assessments are an accumulation of work from the JFSC the Government of Jersey the States of Jersey Police the Law Officers Department and numerous professionals across the finance industry. Coming into force 4th February 2008.

Made 28th January 2008. To provide businesses with more detail on what we found during those examinations and the steps they need. In January 2015 Jersey published a typologies report outlining laundering methods and techniques of concern including tax evasion corruption laundering the proceeds of corruption with the involvement of politically exposed persons PEPs the use of money service businesses and.

The NRA is the first public centrally co- ordinated risk assessment of money laundering undertaken in the Island. Its reputation may be undermined and its financial services subverted by the activities of money. Jersey has published its first official assessment of the risk of the island being used by criminals to launder the proceeds of crime.

In Jersey at least where JFSC guidance was that a risk based assessment should be carried out Mrs Jardine and STM could demonstrate they had done this and reached reasonable conclusions. The National Risk Assessment of Money Laundering is the first study of its kind and has been made public by the Government of Jersey. The NRA is the first public centrally co- ordinated risk assessment of money laundering undertaken in the Island.

It analyses financial activity in Jersey between 2013 to 2018. Jersey publishes first risk assessment for money laundering. Once these risks are properly understood countries will be able to implement anti-money laundering and counter terrorist financing measures that mitigate these risks.

B there is little risk of money laundering occurring as a result of completing such identification after the establishment of that relationship. It analyses financial activity in Jersey between 2013 to 2018. THE MINISTER FOR TREASURY AND RESOURCES in pursuance of Articles 37 and 43 of the Proceeds of Crime Jersey Law 19991 and having consulted the Jersey Financial Services Commission orders as follows.

These handbooks set out the legislative and regulatory requirements for the prevention and detection of money laundering and the financing of terrorism AML CFT Handbook for. We have a social and. One of the key requirements of the FATF Recommendations is for countries to identify assess and understand the money laundering ML and terrorist financing TF risks that they are exposed to.

Jersey is however exposed to the same risks faced by all financial centres. Money Laundering Jersey Order 2008. The Island had to act because the international standard setter on financial crime called the Financial Action Task Force recommended that every.

Laundering and terrorist financing risks they face and to take action to effectively mitigate those risks. Abu Dhabi Commercial Bank Jersey ADCB Jersey branch were this afternoon Wednesday 5 February brought before Jerseys highest court to be sentenced for a single charge of failing to fully carry out its anti-money laundering duties in relation to the use of two Jersey bank accounts in the United Arab Emirates. The Assessment reviews all of the key sectors of the financial services industry in Jersey and the regulatory and law enforcement infrastructure dedicated to combatting financial crime linked to the island.

As an International Finance Centre Jersey is inevitably exposed to money laundering threats. They concluded there was no money laundering risk and the prosecution could not show there was in fact any money laundering. Crime and supervisory risk examinations In March and May we shared the findings from our 2020 financial crime and supervisory risk examinations which identified supervised businesses non-compliance with statutory and regulatory requirements.

52 5 Where a relevant person carries out a one-off transaction to which Article 41bii Article 41dii or Article 41fii applies that person must apply identification measures as soon as reasonably practicable. Jersey has a long-standing commitment to be a leader in the global fight against financial crime.

Jersey S 8 000 Steps Toward Combating Money Laundering Comment

Jersey May Have Been Vulnerable To Money Laundering Due To Lack Of Staff Training Itv News Channel

How To Improve Your Aml Compliance And Prevent Money Laundering Vistra

.jpg)

The Top Money Laundering Cases In Recent Times

Thetaray Raises 31 Million To Weed Out Fraud From Money Transfers The Times Of Israel

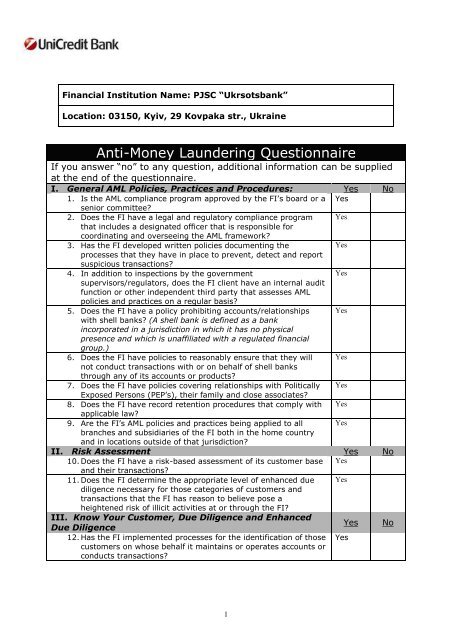

Anti Money Laundering Questionnaire Unicredit Bank Pjsc

Malaysia To Stop Petrosaudi From Using Stolen 1mdb Funds Held In Uk Bank Account Money Laundering Finance Scandal

South Korea Digital Currency Exchanges To Face Penalties For Anti Money Laundering Breaches Coingeek

Malta S Regulator Fines Credorax Bank Over Anti Money Laundering Breaches Money Laundering Business Risk Financial Institutions

Some Like It Hot Money Laundering Criminal Justice Some Like It Hot

Revised Central Bank Amla Guidelines Anti Money Laundering

Infographic Of Anti Money Laundering Aml Analysis Raconteur Net Money Laundering Finance Infographic Infographic

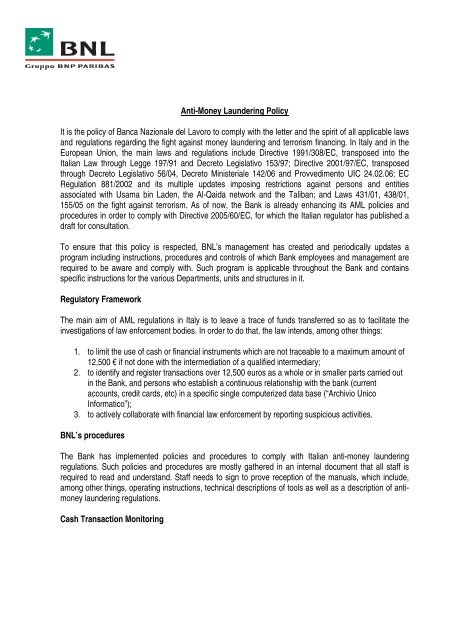

Anti Money Laundering Policy It Is The Policy Of Banca Bnl

The world of rules can seem to be a bowl of alphabet soup at instances. US cash laundering rules are no exception. We have compiled a list of the highest ten money laundering acronyms and their definitions. TMP Danger is consulting agency targeted on defending monetary companies by lowering risk, fraud and losses. Now we have huge financial institution experience in operational and regulatory risk. We have now a powerful background in program management, regulatory and operational threat in addition to Lean Six Sigma and Enterprise Course of Outsourcing.

Thus money laundering brings many hostile penalties to the organization as a result of dangers it presents. It will increase the chance of main dangers and the chance value of the financial institution and finally causes the bank to face losses.

Comments

Post a Comment